Foundational accounting concepts are generally taught in which course s? This question lies at the heart of this exploration into the pedagogical landscape of accounting education. As we delve into this topic, we will uncover the typical courses where these concepts are introduced, the reasons behind their inclusion, and the assessment methods employed to gauge students’ understanding.

These foundational concepts serve as the building blocks upon which students construct their accounting knowledge. They provide a framework for understanding the language of business and the intricacies of financial reporting. By grasping these concepts, students gain a solid foundation for their future endeavors in the field of accounting.

Foundational Accounting Concepts in Introductory Courses: Foundational Accounting Concepts Are Generally Taught In Which Course S

Foundational accounting concepts are typically introduced to students in introductory accounting courses. These courses provide an overview of the basic principles and practices of accounting, and they lay the groundwork for more advanced accounting study.

Some examples of introductory courses that cover foundational accounting concepts include:

- Principles of Accounting I

- Financial Accounting

- Managerial Accounting

Foundational accounting concepts are taught in introductory courses because they are essential for students to understand the basics of accounting. These concepts provide a framework for understanding how accounting information is used to make decisions, and they help students to develop the skills they need to prepare and interpret financial statements.

Scope of Foundational Accounting Concepts

The core foundational accounting concepts typically taught in introductory courses include:

- The accounting equation

- The double-entry system

- Debits and credits

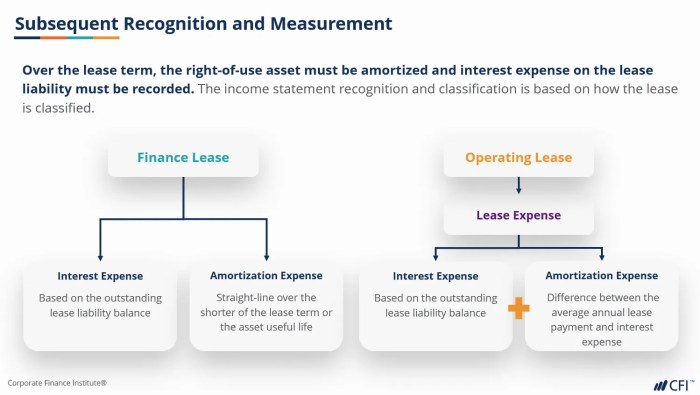

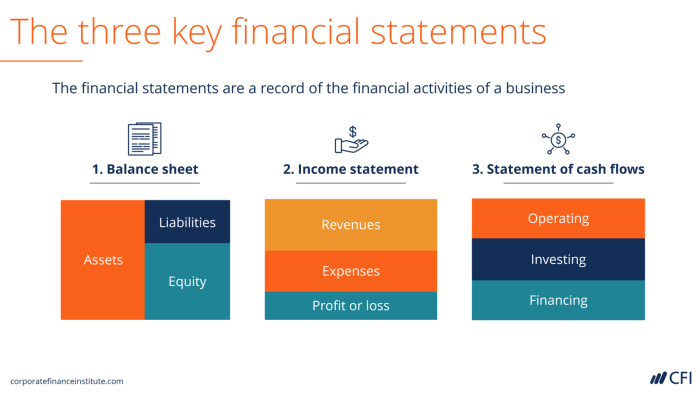

- Financial statements

- The accounting cycle

These concepts are essential for students to understand because they provide the foundation for all accounting activities. By understanding these concepts, students can begin to develop the skills they need to prepare and interpret financial statements, and they can gain a deeper understanding of how accounting information is used to make decisions.

Teaching Methods for Foundational Accounting Concepts, Foundational accounting concepts are generally taught in which course s

There are a variety of teaching methods that can be used to convey foundational accounting concepts to students. Some common methods include:

- Lectures

- Discussions

- Case studies

- Problem-solving exercises

The most effective teaching methods will vary depending on the learning style of the students and the size of the class. However, all of these methods can be used to help students understand the basic principles of accounting.

Assessment of Foundational Accounting Concepts

There are a variety of methods that can be used to assess students’ understanding of foundational accounting concepts. Some common methods include:

| Assessment Method | Advantages | Disadvantages |

|---|---|---|

| Exams | Can be used to assess students’ understanding of a wide range of concepts | Can be stressful for students |

| Quizzes | Can be used to assess students’ understanding of specific concepts | Can be time-consuming to grade |

| Homework assignments | Can be used to assess students’ ability to apply concepts to real-world situations | Can be difficult to design |

| Projects | Can be used to assess students’ ability to work independently and solve problems | Can be time-consuming to grade |

The most effective assessment methods will vary depending on the learning objectives of the course and the size of the class. However, all of these methods can be used to help instructors assess students’ understanding of foundational accounting concepts.

Integration with Other Business Disciplines

Foundational accounting concepts are essential for students in all business disciplines. These concepts provide a common language that can be used to communicate financial information across different departments and organizations. By understanding foundational accounting concepts, students can gain a deeper understanding of how businesses operate and make decisions.

The following table illustrates the interrelationships between accounting and other business disciplines:

| Business Discipline | How Accounting Concepts Are Used |

|---|---|

| Finance | To analyze financial statements and make investment decisions |

| Marketing | To track marketing expenses and measure the effectiveness of marketing campaigns |

| Operations | To track production costs and manage inventory |

| Human resources | To track employee costs and benefits |

Real-World Applications of Foundational Accounting Concepts

Foundational accounting concepts are used in a variety of industries. Some examples include:

- Public accounting firms use accounting concepts to prepare financial statements for their clients.

- Private companies use accounting concepts to track their financial performance and make decisions.

- Government agencies use accounting concepts to track their spending and revenue.

- Nonprofit organizations use accounting concepts to track their financial resources and ensure that they are meeting their mission.

The following case study illustrates the practical applications of foundational accounting concepts:

XYZ Company is a manufacturing company that produces and sells widgets. The company’s management team is considering expanding its operations into a new market. To make this decision, the management team needs to understand the company’s financial performance. The company’s accountant prepares financial statements that show the company’s revenue, expenses, and profits.

The management team uses this information to make informed decisions about the company’s future.

FAQ Insights

Which courses typically cover foundational accounting concepts?

Foundational accounting concepts are typically introduced in introductory accounting courses, such as Principles of Accounting I and II.

Why are foundational accounting concepts taught in introductory courses?

These concepts provide a foundation for understanding more advanced accounting topics and are essential for students pursuing careers in accounting or business.

How are foundational accounting concepts assessed?

Assessment methods include exams, quizzes, homework assignments, and case studies.