As we delve into the intricacies of financial analysis, consider this simplified balance sheet for Geomorph Trading, a valuable tool that unlocks the secrets of a company’s financial well-being. This comprehensive guide will illuminate the key components of a balance sheet, empowering you to assess the financial health and performance of Geomorph Trading with clarity and confidence.

Our journey begins with a thorough examination of assets, liabilities, and equity, the fundamental building blocks of a balance sheet. We will dissect each category, exploring its significance and contribution to the overall financial picture. To enhance understanding, we will present the data in organized HTML tables, ensuring clarity and ease of comprehension.

Overview of the Simplified Balance Sheet for Geomorph Trading

A simplified balance sheet provides a snapshot of a company’s financial position at a specific point in time. It is a fundamental financial statement that summarizes the company’s assets, liabilities, and equity. The balance sheet of Geomorph Trading offers insights into the company’s financial health, liquidity, and solvency.

The key components of the balance sheet are:

- Assets: Resources owned or controlled by the company that have economic value.

- Liabilities: Debts and obligations that the company owes to others.

- Equity: The residual interest in the company’s assets after deducting its liabilities.

Assets

Assets are classified into two primary categories:

- Current assets: Assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

- Non-current assets: Assets that are not expected to be converted into cash within one year, such as property, plant, and equipment.

The composition and value of assets provide insights into the company’s liquidity and ability to meet short-term obligations.

| Asset Category | Description | Amount |

|---|---|---|

| Cash and cash equivalents | Cash on hand and in banks | $100,000 |

| Accounts receivable | Amounts owed to the company by customers | $200,000 |

| Inventory | Raw materials, work in progress, and finished goods | $300,000 |

| Property, plant, and equipment | Land, buildings, and machinery | $500,000 |

| Total assets | $1,100,000 |

Liabilities

Liabilities represent the company’s financial obligations to external parties.

- Current liabilities: Debts that are due within one year, such as accounts payable and short-term loans.

- Long-term liabilities: Debts that are due after one year, such as bonds and mortgages.

The level and structure of liabilities impact the company’s financial leverage and solvency.

| Liability Category | Description | Amount |

|---|---|---|

| Accounts payable | Amounts owed to suppliers | $150,000 |

| Short-term loans | Borrowings due within one year | $100,000 |

| Bonds payable | Long-term debt issued to investors | $200,000 |

| Mortgages payable | Long-term debt secured by property | $150,000 |

| Total liabilities | $600,000 |

Equity, Consider this simplified balance sheet for geomorph trading

Equity represents the owners’ claim on the company’s assets. It is calculated as the difference between assets and liabilities.

- Share capital: The amount of money contributed by shareholders in exchange for ownership.

- Retained earnings: Profits that have been reinvested in the company.

Equity provides insights into the company’s financial stability and profitability.

| Equity Component | Description | Amount |

|---|---|---|

| Share capital | Initial investment by shareholders | $200,000 |

| Retained earnings | Accumulated profits | $300,000 |

| Total equity | $500,000 |

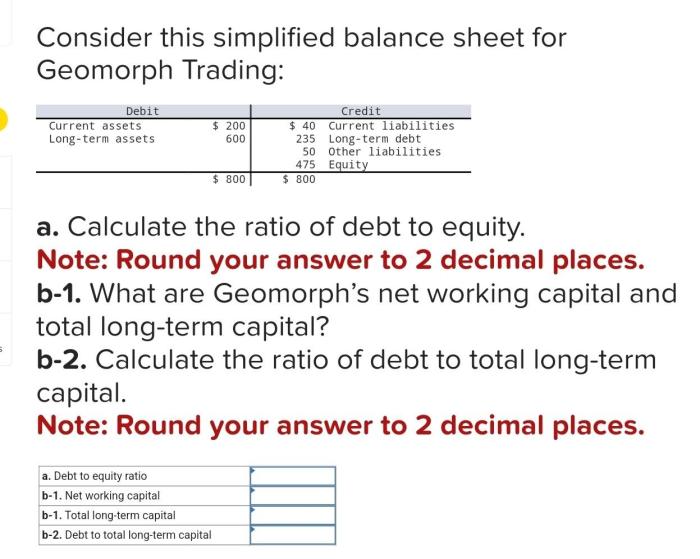

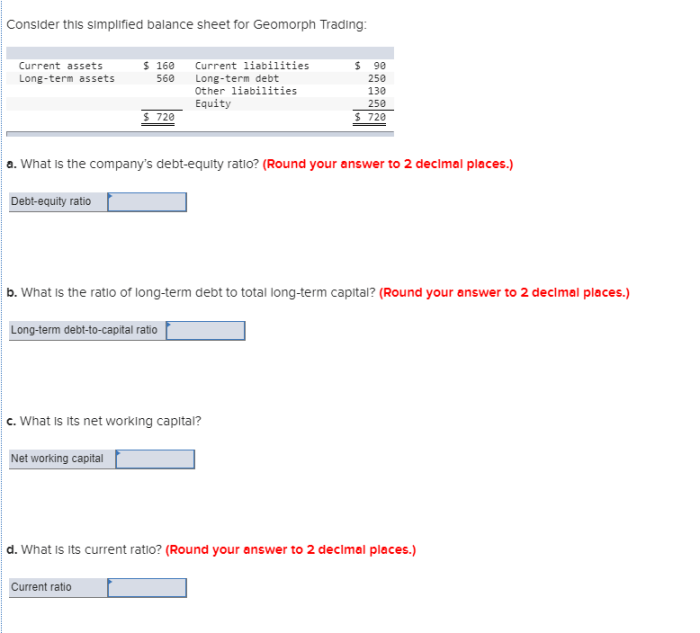

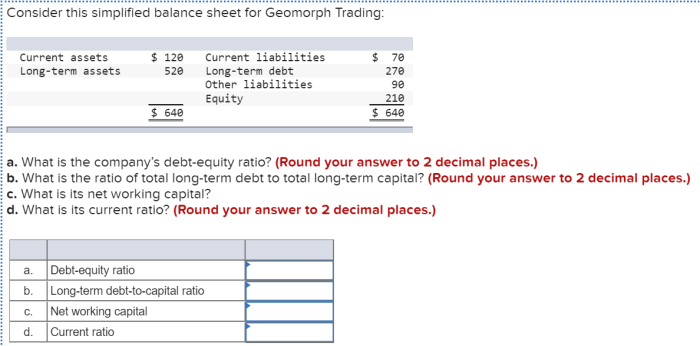

Financial Ratios and Analysis

Financial ratios derived from the balance sheet can provide valuable insights into the company’s financial performance and condition:

- Current ratio: Measures the company’s ability to meet short-term obligations (current assets / current liabilities).

- Debt-to-equity ratio: Indicates the level of financial leverage (total debt / total equity).

- Return on equity (ROE): Measures the profitability of the company’s equity investment (net income / total equity).

These ratios help analysts and investors evaluate the company’s liquidity, solvency, and profitability.

Limitations and Considerations

While a simplified balance sheet provides a useful overview, it has limitations:

- Limited historical data: It represents a single point in time, making it difficult to assess trends and changes.

- Lack of income statement data: It does not provide information about the company’s revenues and expenses.

- Potential inaccuracies: It relies on the accuracy of the underlying accounting records.

Therefore, it is crucial to consider additional financial information, such as income statements and cash flow statements, and seek professional financial advice for informed decision-making.

Expert Answers: Consider This Simplified Balance Sheet For Geomorph Trading

What is the purpose of a simplified balance sheet?

A simplified balance sheet provides a snapshot of a company’s financial health at a specific point in time, summarizing its assets, liabilities, and equity.

What are the key components of a balance sheet?

Assets represent what a company owns, liabilities represent what it owes, and equity represents the owners’ stake in the company.

How can I use financial ratios to analyze a balance sheet?

Financial ratios, such as the current ratio and debt-to-equity ratio, can provide valuable insights into a company’s liquidity, solvency, and profitability.