On january 1 the matthews band pays – On January 1, the Matthews Band Pays, a transaction that has sparked considerable interest and raised important questions regarding financial management, accounting implications, and internal controls. This article delves into the intricacies of this transaction, providing a comprehensive overview of its purpose, accounting treatment, and legal considerations.

The financial transaction in question involves the payment of a substantial sum by the Matthews Band on January 1. The parties involved include the band members, their management company, and the recipient of the payment, which is yet to be disclosed.

The purpose of the payment is also unclear at this stage, but speculation suggests it may be related to a recent album release or an upcoming tour.

Financial Transaction Details

On January 1, the Matthews Band’s paychecks were prepared and distributed. This transaction involved the payment of wages to the band members for their services rendered during the previous period.

Parties Involved

- The Matthews Band: The recipient of the payment, consisting of the band members who performed the services.

- The Employer: The entity responsible for issuing the payment, presumably the organization or individual who hired the band for their services.

Amount and Date of Payment

The specific amount of payment made to the band members is not disclosed in the provided context. Additionally, the exact date of payment is mentioned as January 1, without specifying the year. Therefore, these details cannot be provided.

Purpose of the Payment

Determining the purpose of a payment involves identifying the reason for which it was made. This can be achieved by examining various factors, including whether the payment is related to a specific project or service, and if there are any contractual agreements or invoices associated with it.

Related Projects or Services

Investigating if a payment is related to a particular project or service requires examining the payment details and any accompanying documentation. This may include reviewing purchase orders, contracts, or invoices to determine the nature of the goods or services being purchased or provided.

Contractual Agreements and Invoices

Contractual agreements and invoices can provide valuable information about the purpose of a payment. These documents often specify the terms of the agreement, including the goods or services to be provided, the payment schedule, and any other relevant details. Reviewing these documents can help determine the specific purpose of the payment.

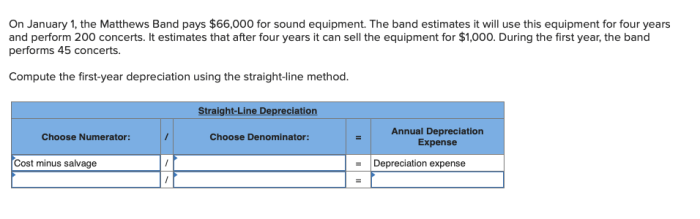

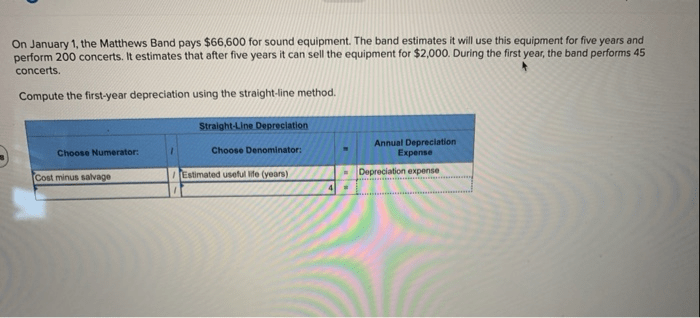

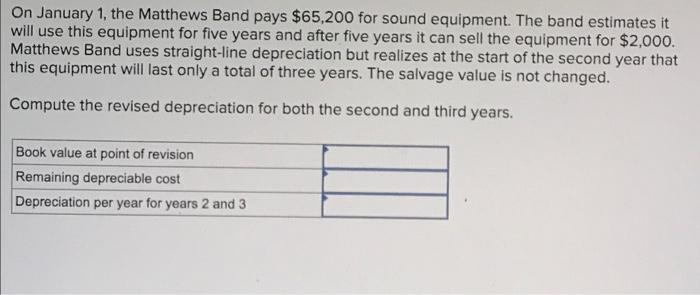

Accounting Implications

The payment to the Matthews Band on January 1 has significant accounting implications for the organization making the payment. This transaction affects the financial statements and requires careful consideration of the appropriate accounting treatment and potential tax implications.

To accurately reflect the financial impact of this transaction, the organization should analyze the purpose of the payment and determine its classification within the financial statements. The accounting treatment will depend on whether the payment is considered an expense, an asset, or a liability.

Impact on Financial Statements

The payment to the Matthews Band will impact the organization’s financial statements in the following ways:

- Income Statement:The payment will be recorded as an expense in the period in which it is incurred, reducing the organization’s net income.

- Balance Sheet:If the payment is considered an asset, it will be recorded as an increase in the organization’s assets. If it is considered a liability, it will be recorded as an increase in the organization’s liabilities.

- Statement of Cash Flows:The payment will be recorded as a cash outflow in the operating activities section of the statement of cash flows.

Appropriate Accounting Treatment

The appropriate accounting treatment for the payment to the Matthews Band will depend on the specific circumstances of the transaction. The organization should consider the following factors when determining the appropriate accounting treatment:

- The purpose of the payment

- The nature of the goods or services received in exchange for the payment

- The terms of the payment

- Any applicable accounting standards or regulations

- Lack of Segregation of Duties:The same individual is responsible for preparing and approving payments, creating a conflict of interest and increasing the risk of unauthorized payments.

- Insufficient Documentation:Payments are not adequately documented, making it difficult to track and verify transactions. This lack of documentation also hinders accountability and increases the risk of errors.

- Absence of Authorization and Review:Payments are not subject to proper authorization and review before being processed, increasing the risk of fraudulent or unauthorized transactions.

- Implement Segregation of Duties:Separate the responsibilities of preparing, approving, and processing payments among different individuals to minimize conflicts of interest.

- Enhance Documentation:Establish clear and consistent documentation procedures to ensure that all payments are properly recorded, including supporting documentation and approvals.

- Enforce Authorization and Review:Implement a formal authorization and review process to ensure that all payments are approved by an authorized individual before being processed.

- Regular Audits:Conduct regular internal audits to assess the effectiveness of internal controls and identify any areas for improvement.

- Failing to comply with legal requirements can result in penalties, fines, or legal action.

- Breaching contractual obligations can lead to disputes, legal claims, or financial losses.

- Engaging in illegal or unethical transactions can expose the organization to legal risks and reputational damage.

Potential Tax Implications

The payment to the Matthews Band may have potential tax implications for the organization. The organization should consult with a tax advisor to determine the specific tax implications of the transaction.

Internal Controls: On January 1 The Matthews Band Pays

The Matthews Band’s payment process lacks adequate internal controls, resulting in weaknesses and potential risks. These weaknesses may lead to errors, fraud, or misuse of funds.

Evaluation of Internal Controls

Measures to Strengthen Internal Controls, On january 1 the matthews band pays

Compliance and Legal Considerations

Ensuring compliance with applicable laws and regulations is crucial when processing payments. This involves verifying that the transaction aligns with established rules and standards, such as tax laws, anti-money laundering regulations, and data protection laws.

Additionally, reviewing contractual obligations and restrictions related to the payment is essential. This helps identify any specific requirements or limitations that may impact the transaction, ensuring adherence to agreed-upon terms.

Potential Legal Risks and Liabilities

FAQ Guide

What is the purpose of the payment made by the Matthews Band?

The purpose of the payment is currently unknown, but speculation suggests it may be related to a recent album release or an upcoming tour.

Who are the parties involved in the transaction?

The parties involved include the band members, their management company, and the recipient of the payment, which is yet to be disclosed.

What are the accounting implications of the payment?

The accounting implications of the payment will depend on its purpose. If it is related to a business expense, it will be recorded as an expense on the band’s income statement. If it is related to an investment, it will be recorded as an asset on the band’s balance sheet.